Building Financial Stability Through Smart Management 3334545544

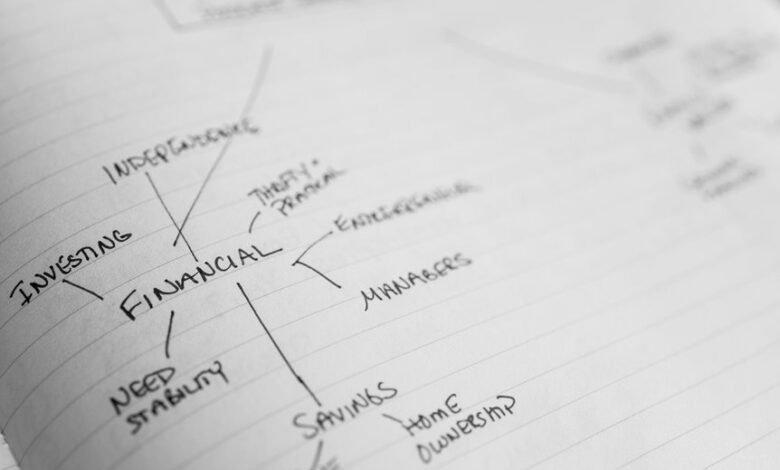

Building financial stability through smart management requires a strategic approach that encompasses budgeting, saving, and investing. Individuals must recognize the significance of establishing a clear budget to guide their financial decisions. Effective saving practices can create a buffer against unexpected expenses. Additionally, informed investment strategies are crucial for long-term wealth accumulation. Understanding how these elements intertwine can lead to more resilient financial health, prompting further exploration of the necessary steps to achieve lasting stability.

Understanding the Importance of Budgeting

Although many individuals perceive budgeting as a tedious task, its significance in fostering financial stability cannot be overstated.

Effective budgeting techniques serve as a roadmap towards achieving financial goals, enabling individuals to allocate resources strategically.

Effective Saving Strategies for Future Security

While individuals often recognize the necessity of saving, many struggle to implement effective strategies that ensure long-term financial security.

Establishing an emergency fund serves as a financial buffer, while allocating savings to high yield accounts can maximize growth.

Smart Investing: Building Wealth Over Time

Investing wisely is essential for individuals seeking to build substantial wealth over time, as it allows them to leverage their savings and capitalize on market growth.

Strategic investment diversification is crucial, as it mitigates risk and enhances the potential for long-term growth.

Monitoring and Adjusting Your Financial Plan

How can individuals ensure their financial plans remain aligned with their evolving goals and market conditions?

Regular financial reviews are essential, enabling individuals to assess progress and identify necessary plan adjustments.

By proactively monitoring key indicators, they can adapt their strategies, safeguarding their financial freedom.

This dynamic approach empowers individuals to navigate uncertainties, ensuring their financial plans remain robust and responsive to change.

Conclusion

In conclusion, achieving financial stability is akin to cultivating a resilient garden; it requires careful planning, nurturing, and adaptability to thrive. By mastering budgeting, implementing effective saving strategies, and engaging in smart investing, individuals can sow the seeds for long-term prosperity. Regularly monitoring and adjusting their financial plans ensures that they remain aligned with evolving goals, ultimately fostering a robust financial landscape that can weather life’s storms and flourish over time.